Getting paid on-line ought to be easy. However for a lot of WordPress retailer homeowners, it may be tremendous complicated – particularly whenever you’re a newbie. There are numerous cost instruments to select from, complicated tech phrases to be taught, and complex setup steps to comply with.

We are able to relate – you simply wish to settle for funds with no bunch of issues.

We’ve been utilizing common cost processors like Stripe and PayPal in our personal eCommerce shops for a number of years now. And alongside the way in which, we’ve realized totally different recommendations on organising safe cost programs.

On this newbie’s information, we’ll share every thing you have to know so you can begin simply accepting funds in your WordPress web site.

We’ll educate you ways cost processors work, one of the best plugins to make use of, and the way to decide on the correct cost gateway for what you are promoting. We may even share some suggestions and methods to promote various kinds of merchandise on-line.

Right here’s a fast overview of what we’ll go over in our in-depth information to WordPress cost processing:

Now, let’s begin by having a look at what cost processors really are.

What Are Fee Processors, and How Do They Work?

A cost processor is a service that handles on-line transactions between your prospects and your financial institution.

You’ll be able to consider it because the intermediary that makes certain cash strikes safely from a purchaser’s cost technique, like a bank card or digital pockets, to what you are promoting account.

If you’re working a WordPress web site, you possibly can’t settle for funds immediately as a result of WordPress doesn’t include any built-in performance for this. That’s why you want a cost processor like Stripe, PayPal, or Sq. to deal with the technical facet of issues.

These companies combine with WordPress via plugins. This makes it simple to gather funds without having to know how you can code or arrange advanced programs.

Basically, when a buyer makes a purchase order in your web site, their cost particulars are despatched to the cost processor. The platform then contacts the client’s financial institution or card supplier to test if they’ve sufficient funds.

If every thing seems to be good, the cost is authorised, and the cash is transferred to your account. On the identical time, the processor helps shield each you and your prospects by encrypting information and blocking faux funds.

In brief, cost processors deal with every thing to make on-line transactions easy and safe.

If you use the correct processor in your WordPress web site, you possibly can settle for funds simply whereas conserving what you are promoting and your prospects secure.

What Is the Distinction Between Fee Processors and Fee Gateways?

Fee processors and cost gateways work collectively to deal with on-line transactions, however they don’t seem to be the identical factor.

A cost processor is a service that strikes cash between your buyer’s financial institution and what you are promoting account. It handles issues like verifying funds, approving transactions, and ensuring the cash will get to you securely.

However, a cost gateway is a device that collects and transfers cost particulars out of your web site to the cost processor. It acts because the bridge between your on-line retailer and the processor, ensuring that delicate information is protected.

Some companies, like Stripe and PayPal, act as each a gateway and a processor, which makes setup simpler.

In brief, the cost gateway handles the front-end course of, like accumulating cost data from prospects, whereas the cost processor does the back-end work of transferring the cash.

Which eCommerce Fee Choices Are Obtainable in WordPress?

In the case of eCommerce cost choices for WordPress, you may have a number of nice decisions.

We advocate utilizing PayPal and Stripe as a result of they’re each extensively trusted and simple to combine with common eCommerce plugins like WooCommerce, Straightforward Digital Downloads, and WPForms.

These two choices are nice for learners as a result of they provide easy setup processes and highly effective safety features. Additionally they help quite a lot of cost strategies, together with bank cards, debit playing cards, and digital wallets.

Nonetheless, PayPal and Stripe aren’t your solely decisions. If you wish to give your prospects extra flexibility, then you can too contemplate integrating different cost choices.

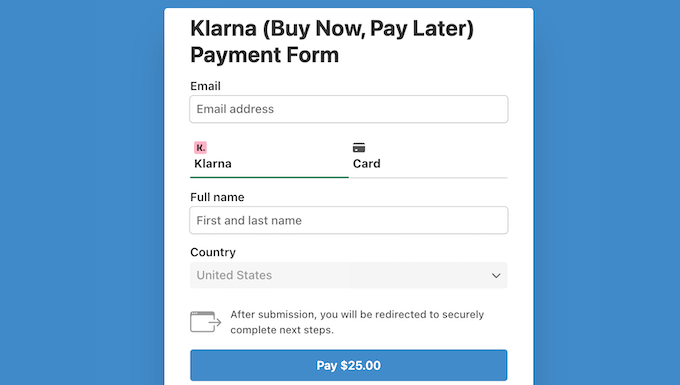

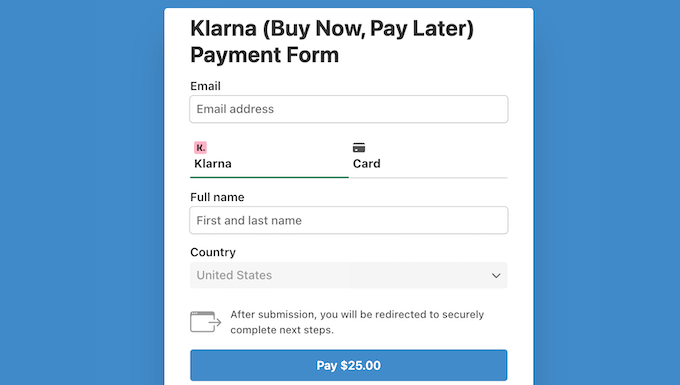

As an example, ‘Purchase Now, Pay Later’ companies like Klarna permit prospects to separate their funds into installments, which could be a nice choice if you’re promoting costly objects.

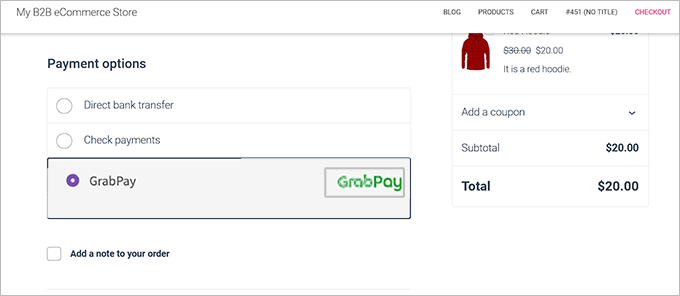

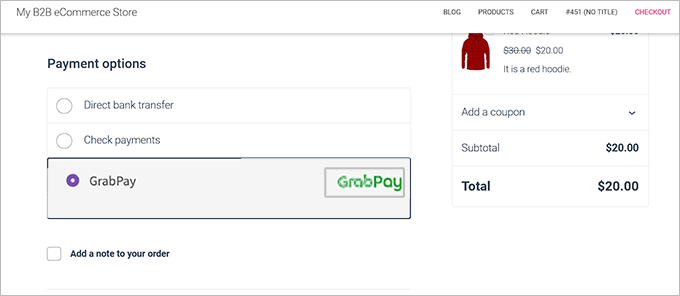

An alternative choice is integrating digital wallets like Apple Pay and even regional cost companies like Bancontact, SEPA, or GrabPay.

These choices are rising in popularity as customers search for handy methods to pay for his or her on-line purchases.

Finally, one of the best cost choices on your eCommerce retailer will rely in your pricing mannequin, target market, and geographic attain.

Whether or not you keep on with PayPal and Stripe or department out with choices like Klarna or GrabPay, the secret’s to offer your prospects with a seamless and safe checkout expertise.

This is not going to solely enable you to improve conversions but in addition construct belief together with your prospects, making them extra more likely to return for future purchases.

Issues to Take into account When Selecting a Fee Processor

Not all cost processors are the identical. After testing totally different choices on our eCommerce websites, we’ve realized that selecting the best one could make a huge impact in your revenue margins and day by day operations.

Listed below are some key components to remember when choosing a processor on your on-line enterprise:

- Transaction Charges: We’ve got used processors with totally different payment buildings, and people transaction prices can add up shortly. Most cost a proportion of every sale plus a set quantity, whereas some have month-to-month charges. We advocate evaluating prices so that you don’t overpay.

- Processing Time: Not all cost processors ship funds to your account immediately. Some take a few days, whereas others provide same-day payouts with an additional payment. In our expertise, sooner payouts are nice, however they could include hidden fees.

- Worldwide Funds: Should you plan to promote globally, your cost processor ought to help worldwide funds and a number of currencies. Earlier than making your alternative, be certain that to analysis totally as a result of we’ve seen some companies cost further for overseas transactions.

- Fee Choices: In case your cost processor solely accepts bank cards, this may nearly actually result in misplaced gross sales. A very good processor ought to provide a number of cost strategies, together with digital wallets like Apple Pay and Google Pay, and even purchase now, pay later (BNPL) choices.

- System Compatibility: A lot of our prospects store from their telephones, so having a mobile-friendly checkout is a should. Ensure that your cost system works seamlessly throughout desktops, tablets, and cellular gadgets.

- Transaction Safety: Safety is a high precedence. Select a processor that gives encryption, fraud detection, and compliance with PCI DSS security standards to guard buyer information.

- Buyer Assist: Fee points are fairly frequent. When that occurs, good buyer help could be a lifesaver. We advocate selecting a processor that gives 24/7 help via stay chat, cellphone, or e mail.

From testing totally different cost options, we’ve seen how the correct processor can enhance buyer expertise and enhance conversions.

Finest Fee Processors for WordPress Websites🏆

Now that what to search for in a WordPress cost processor, let’s talk about a number of the greatest choices obtainable for WordPress.

Right here’s a fast take a look at our knowledgeable picks:

| # | Processor | Finest For | Transaction Charges |

|---|---|---|---|

| 🥇 | Stripe | Finest general WordPress cost processor | 2.9% + 30¢ |

| 🥈 | PayPal | Worldwide shops (200+ international locations/areas) | Beginning at 2.99% + a set payment |

| 🥉 | Square | WooCommerce shops with bodily places | 2.9% + 30¢ for on-line gross sales |

| 4 | Authorize.net | Rising companies and membership websites | 2.9% + 30¢ + month-to-month gateway charges |

| 5 | Braintree | Small on-line shops and web sites | 2.9% + 30¢ |

📣 Why Belief WPBeginner?

At WPBeginner, we run a number of eCommerce websites and use each Stripe and PayPal to course of funds. This enables us to promote our merchandise to prospects all around the world.

We’ve got additionally examined different cost processors and narrowed them right down to those that stand out for his or her reliability, ease of use, and safety.

Whether or not you’re simply beginning out or scaling up what you are promoting, these cost processors may also help you handle transactions easily. For extra particulars, see our editorial course of.

1. Stripe

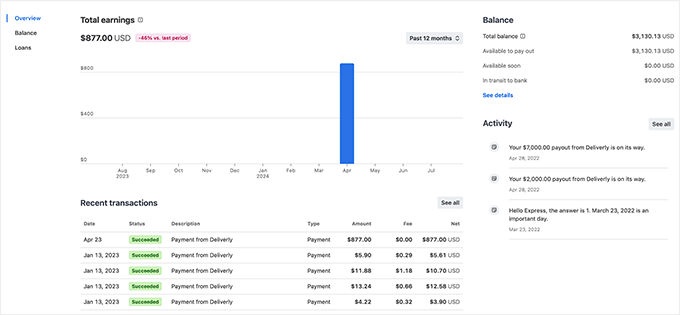

In our opinion, Stripe is, palms down, one of the best WordPress cost processor in the marketplace. We’ve got been utilizing it in all of our eCommerce shops and have discovered it to be safe, dependable, and simple to handle.

One of many largest causes Stripe stands out is how easy it’s to combine it with WordPress. With plugins like WooCommerce, Easy Digital Downloads (EDD), and WPForms, including Stripe to your checkout course of is fast and easy.

Plus, it’s tremendous responsive and works easily throughout totally different gadgets, from desktops to cellphones.

Stripe additionally gives aggressive transaction charges of round 2.9% + 30¢ per transaction for U.S.-based playing cards. We actually admire that there’s no month-to-month payment or hidden fees, which makes it an reasonably priced choice.

The platform additionally helps worldwide funds, which is ideal when you plan to promote globally.

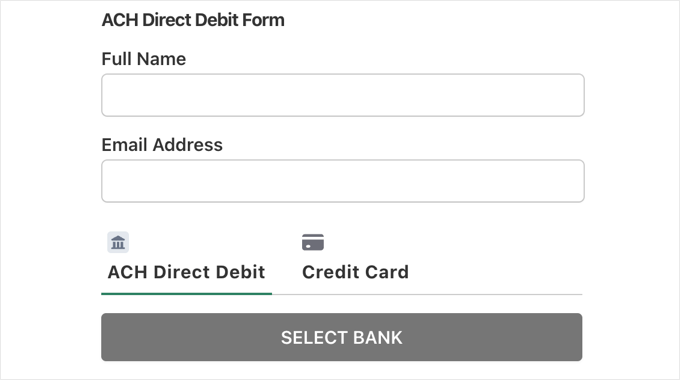

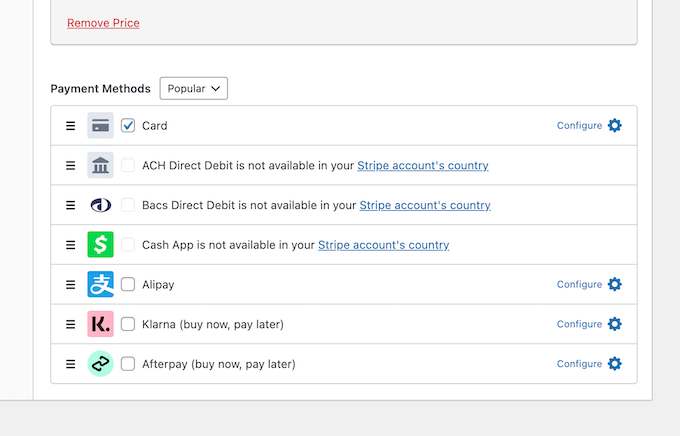

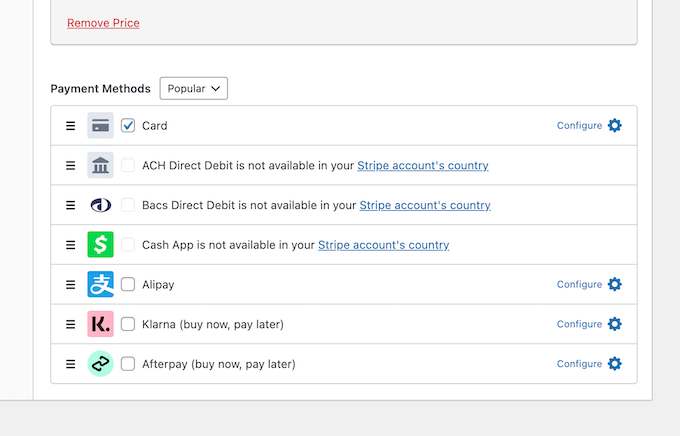

One other main plus is that Stripe can deal with quite a lot of cost strategies. It accepts credit score and debit playing cards, digital wallets like Apple Pay and Google Pay, in addition to choices like ACH funds and Purchase Now, Pay Later options.

That is tremendous handy for web shoppers and may also help velocity up the checkout course of.

We additionally love Stripe’s safety features. With built-in fraud prevention and powerful encryption, you possibly can make sure that your transactions are secure.

Plus, the processor is PCI DSS compliant, which is a safety customary that protects delicate information and prevents fraud.

Professionals of Stripe

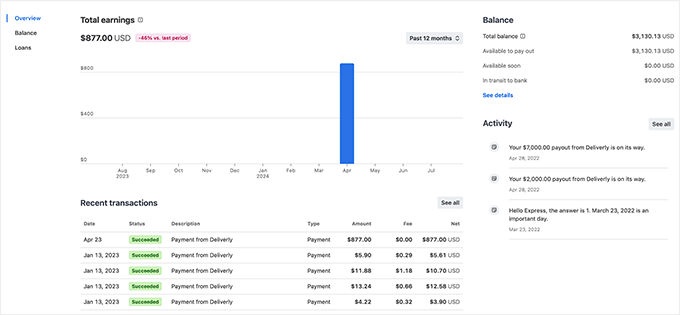

- Stripe’s dashboard is tremendous intuitive.

- We love its detailed reporting instruments. You’ll be able to view in-depth analytics in your gross sales efficiency, monitor buyer cost behaviors, and monitor payouts to your checking account.

- The platform’s Starter plan contains 25 free invoices every month, with a 0.4% payment for each paid bill after that.

- It’s obtainable in over 46 international locations and helps funds in additional than 135 currencies.

- We had been impressed by Stripe’s safety features. It even replaces delicate card particulars with safe tokens to guard buyer information.

Cons of Stripe

- Stripe is obtainable in fewer international locations than PayPal.

☝ Observe: Listed below are the primary cost plugins that supply Stripe as a cost technique:

- WooCommerce: Constructed-in Stripe integration for bank cards, Apple Pay, and Google Pay. That is ultimate for conventional on-line shops. For extra data, see our full WooCommerce overview.

- Straightforward Digital Downloads: You should use it to promote digital merchandise identical to us. Our manufacturers use the built-in Stripe integration to simply accept funds. For particulars, see our full Straightforward Digital Downloads overview.

- WP Easy Pay: A light-weight Stripe cost plugin that you should use to create cost kinds for services. To be taught extra, see our detailed WP Easy Pay overview.

- MemberPress: Helps Stripe for automated membership funds and course gross sales. To get began, see our full MemberPress overview.

Why we advocate Stripe: Total, Stripe is one of the best WordPress cost processor due to its seamless integration with WordPress, simple cost administration, and highly effective options.

2. PayPal

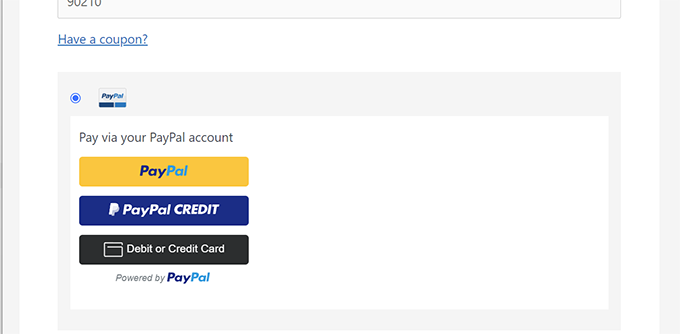

If you’re searching for a cost processor that’s globally obtainable, then PayPal is for you. We use PayPal ourselves and have discovered it to be tremendous user-friendly and dependable.

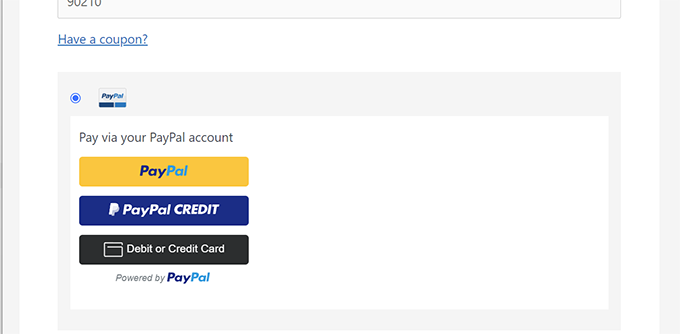

Lots of prospects have already got PayPal accounts, which implies they will make funds shortly without having to enter their bank card particulars each time. This will result in fewer deserted carts and faster checkouts.

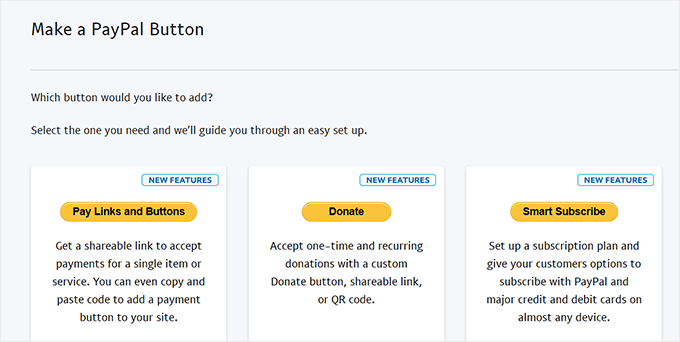

You’ll be able to even provide a easy ‘Pay with PayPal’ button to make the checkout course of simpler.

PayPal additionally gives a variety of fraud safety options, guaranteeing each you and your prospects are protected.

It makes use of superior encryption applied sciences, together with SSL, to guard delicate buyer information and gives 24/7 monitoring to forestall unauthorized transactions.

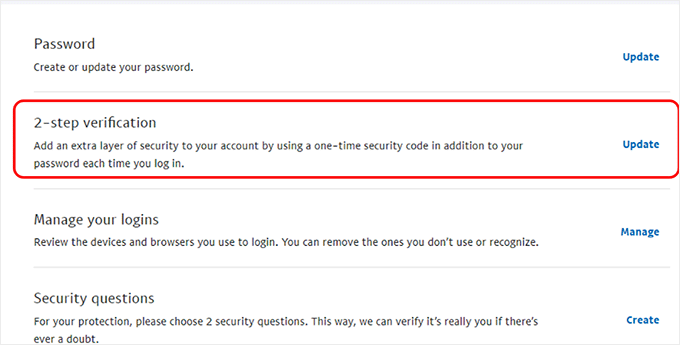

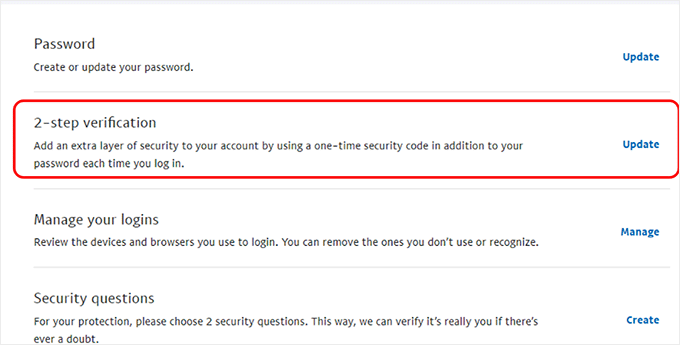

We additionally like its two-factor authentication (2FA) characteristic that provides further safety to your account.

Plus, it’s simple to combine with WordPress, permitting you to simply accept funds seamlessly.

Total, PayPal is a strong cost processor that works properly for a lot of sorts of WordPress websites, from small blogs to bigger on-line shops.

Professionals of PayPal

- PayPal’s dashboard is tremendous beginner-friendly.

- PayPal gives purchaser safety. Because of this the processor will step in if there’s a dispute over a transaction.

- It gives a number of cost choices, together with credit score and debit playing cards, PayPal balances, and even financial institution transfers.

- The platform has a cellular app that makes it simple to view and handle your transactions.

- You may as well see a breakdown of your current gross sales and cost exercise.

Cons of PayPal

- PayPal has increased transaction and conversion charges than Stripe.

☝ Observe: Listed below are the primary cost plugins that supply PayPal as a cost technique:

- WooCommerce: Gives built-in PayPal help for on-line shops.

- Straightforward Digital Downloads: A fantastic choice for promoting digital merchandise with PayPal.

- WPForms: Means that you can settle for PayPal funds via easy order and donation kinds. We additionally use it to create contact kinds and annual surveys. See our full WPForms overview for extra data.

- MemberPress: Helps PayPal for recurring memberships and on-line programs.

Why we advocate PayPal: If you’re searching for a globally obtainable and trusted answer, then we advocate PayPal.

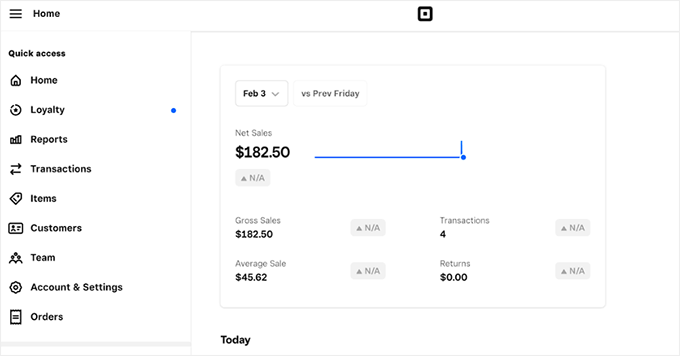

3. Square

Square is a good cost processor for WooCommerce shops with an internet presence and a bodily location. That’s as a result of it might additionally provide you with a whole Level of Sale (POS) system for processing in-person funds.

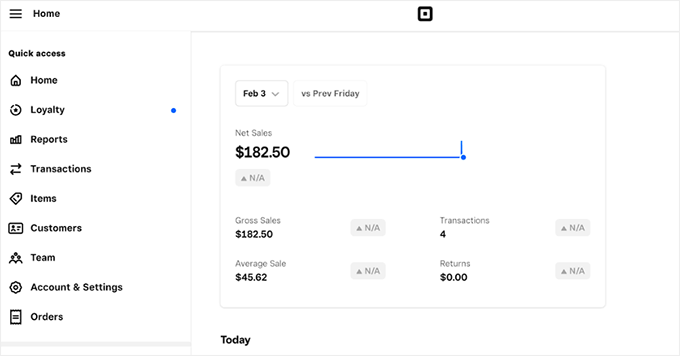

Throughout testing, we discovered that it simply integrates with WordPress and WooCommerce, permitting you to handle your on-line and bodily gross sales multi function place.

Sq. additionally has plenty of flexibility on the subject of cost choices. It accepts all main credit score and debit playing cards, in addition to cellular cost strategies like Apple Pay and Google Pay.

It even helps EMV chip playing cards and contactless funds, that are rising in popularity in bodily shops. This implies your prospects pays nevertheless they like, whether or not they’re purchasing on-line or in particular person.

Sq. additionally has wonderful instruments for managing what you are promoting. From stock administration to reporting and gross sales analytics, its dashboard offers you every thing you have to hold monitor of your gross sales throughout a number of channels.

In brief, it’s a nice cost processor for WooCommerce shops, particularly for companies that promote each on-line and in particular person.

Professionals of Sq.

- Sq. is obtainable in a number of international locations, together with the US, Canada, Australia, Japan, the UK, the Republic of Eire, France, and Spain.

- The transaction payment is often round 2.6% + 10¢ for in-person gross sales and a couple of.9% + 30¢ for on-line gross sales, which is cheap.

- It will probably seamlessly combine with Sq. plugins like WPForms, Charitable, and MemberPress.

- We admire that it gives month-to-month companies, that means you aren’t locked right into a long-term contract.

Cons of Sq.

- If you’re promoting internationally, Sq. requires you to create separate accounts for every nation, every with its personal forex. This will overcomplicate issues.

- Sq. solely offers chargeback safety as much as $250 per thirty days. For companies with increased chargeback volumes, this may increasingly not cowl all disputes.

☝ Observe: Listed below are the primary cost plugins that supply Sq. as a cost technique:

- WooCommerce: We discovered it simple to sync WooCommerce with Sq. to simply accept on-line funds.

- WPForms: Comes with a premium addon to simply accept Sq. funds via kinds, which is nice for small companies.

- WP Charitable: The very best donation and fundraising plugin that allows you to settle for donations by way of Sq. and different cost processors. For particulars, see our WP Charitable overview.

Why we advocate Sq.: In case you have each a bodily and on-line retailer in WordPress, then Sq. is a good choice for managing your transactions in a single place.

4. Authorize.net

Authorize.net is a superb alternative when you have a rising enterprise. It’s dependable and has been round for years, with a strong repute for supporting companies of all sizes.

We love Authorize.Internet as a result of it’s very versatile. You’ll be able to settle for funds on your digital merchandise, bodily items, memberships, recurring subscriptions, and programs, all inside one platform.

Should you provide a month-to-month membership, the cost processor can automate these funds. That manner, your prospects are billed on time immediately.

Authorize.Internet helps a number of cost strategies, from bank cards to eChecks, which implies your prospects have plenty of decisions.

Moreover, it has wonderful safety features to guard delicate cost information.

Professionals of Authorize.web

- Authorize.Internet integrates simply with Authorize.Internet WordPress plugins like WooCommerce, WPForms, Straightforward Digital Downloads, and MemberPress.

- It has nice fraud detection instruments, together with AVS (Handle Verification System) and the choice to allow CAPTCHA.

- It helps cellular funds, permitting you to simply accept funds on the go.

- Authorize.Internet lets you securely retailer buyer cost particulars for future transactions.

Cons of Authorize.web

- In contrast to another cost processors, Authorize.Internet fees a month-to-month payment for its companies, which begins at $25 per thirty days.

- It may be a bit advanced to arrange for learners.

☝ Observe: Listed below are the primary cost plugins that supply Authorize.web as a cost technique:

- WooCommerce: The platform simply integrates with Authorize.web to simply accept bank cards.

- WPForms: The beginner-friendly type builder accepts Authorize.web funds with its addon.

- MemberPress: This LMS helps Authorize.web for recurring funds and membership websites.

Why we advocate Authorize.web: In case you have a rising enterprise or a membership web site, then Authorize.web is a strong choice.

5. Braintree

Braintree is a good cost processor for WordPress-based eCommerce websites. Owned by PayPal, it’s a versatile answer that integrates simply with WordPress plugins.

We included it on the record primarily as a result of it helps quite a few cost strategies, together with credit score and debit playing cards, PayPal, Apple Pay, Google Pay, and even Venmo. This provides your prospects quite a lot of methods to pay, which might result in extra gross sales.

Braintree additionally helps recurring billing, making it an excellent choice for subscription-based companies or membership websites.

Plus, it has highly effective fraud safety instruments, together with information encryption and tokenization.

The processor makes use of a easy, flat-rate pricing mannequin with no setup or month-to-month charges. You’ll simply pay 2.9% + 30¢ per transaction. This may also help you are expecting your cost processing prices simply.

Professionals of Braintree

- Braintree helps funds in over 130 currencies.

- It’s a mobile-friendly cost answer, permitting your prospects to simply make purchases from their smartphones and tablets.

- We had been impressed by Braintree’s Buyer Vault, which securely shops buyer cost data for future transactions.

- The platform has nice buyer help.

Cons of Braintree

- Braintree will not be obtainable in all international locations.

- It has a steeper studying curve than another cost choices.

☝ Observe: Listed below are the primary WordPress cost plugins that supply Braintree as a cost technique:

- WooCommerce: It helps Braintree for accepting PayPal, bank cards, and Apple Pay.

Why we advocate Braintree: In case you have a subscription service or membership web site, then Braintree may very well be appropriate.

Selecting Your Splendid WordPress Fee Plugin

Earlier than you can begin promoting on-line with WordPress, you will have a cost plugin. This device allows you to join your WordPress web site to your most popular cost processors.

That manner, you possibly can securely course of transactions, whether or not you’re promoting bodily merchandise, digital downloads, memberships, or companies.

The very best cost plugin for you’ll rely on what you’re promoting and the kind of retailer you bear in mind.

For instance, if you’re promoting bodily merchandise, then WooCommerce is the most suitable choice. It helps a number of cost gateways like Stripe, PayPal, Sq., and Authorize.web.

For digital merchandise, we advocate Easy Digital Downloads as a result of it’s optimized for promoting downloads and contains built-in Stripe and PayPal help.

However, when you run a membership web site or promote subscriptions, then MemberPress or WP Simple Pay work very properly.

Nonetheless, if what you are promoting wants customized order kinds and subscription containers, then WPForms is probably going a greater choice. With Stripe and PayPal addons, you possibly can create cost kinds that suit your precise wants.

For particulars on all of those choices, simply see our detailed overview of one of the best WordPress eCommerce plugins.

Now that which plugin works greatest for you, let’s stroll via how you can arrange funds in WordPress.

How you can Set Up Fee Processing for Bodily Merchandise 🛍 (WooCommerce)

If you wish to promote bodily merchandise and begin accepting funds on-line, then WooCommerce is the perfect alternative.

It’s a strong plugin that turns your WordPress web site right into a full-featured on-line retailer. It lets you promote merchandise, handle stock, and settle for funds.

Plus, WooCommerce is tremendous versatile and helps all main cost processors, together with Stripe, PayPal, Sq., and even native cost gateways.

With the correct plugins, you can too begin processing funds with only a few clicks.

☝ We all know each setting and have of WooCommerce, and when you’re enthusiastic about our expertise with it, we advocate you take a look at our detailed WooCommerce overview.

For step-by-step directions on how you can begin utilizing WooCommerce, take a look at the WooCommerce part of our information on how you can settle for Stripe funds in WordPress.

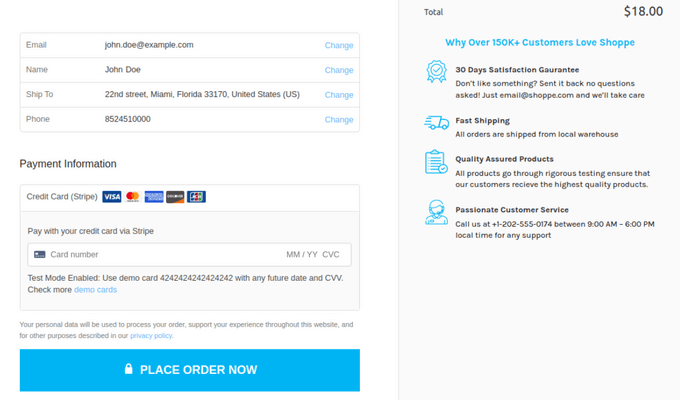

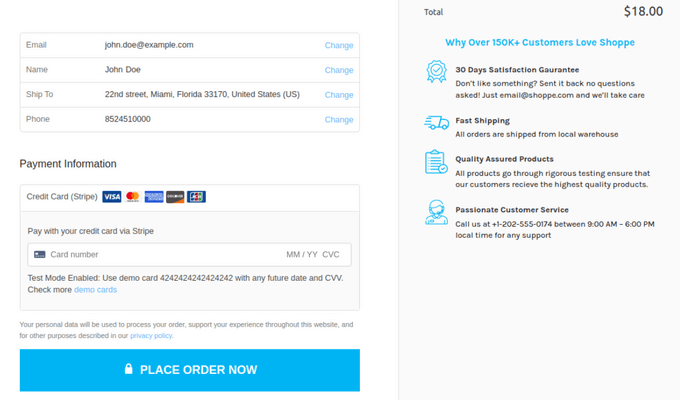

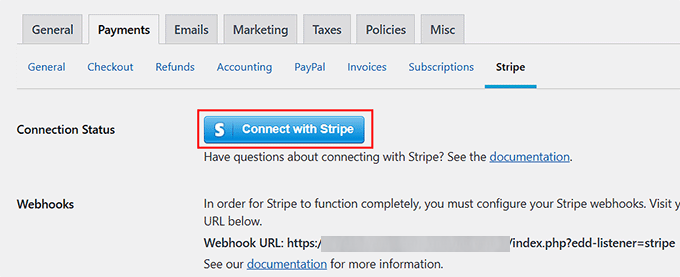

How you can Set Up Fee Processing for Digital Merchandise ⬇️ (eBooks, Software program & Recordsdata)

If you’re promoting digital merchandise like eBooks, software program, or downloadable information, then Easy Digital Downloads (EDD) makes it tremendous simple.

It’s the greatest plugin for promoting digital items and comes with built-in help for Stripe and PayPal, so organising cost processing with both choice is a breeze.

We use EDD to promote our plugins and software program, and it’s labored very well for us. To be taught extra, see our full Straightforward Digital Downloads overview.

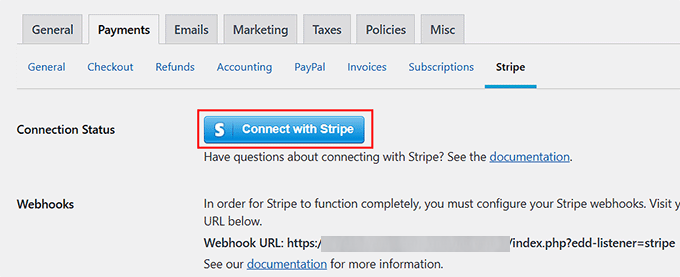

As soon as your retailer is ready up with EDD, you’ll want to go to the Downloads » Settings » Funds web page within the WordPress dashboard.

Then, swap to the ‘Stripe’ or ‘PayPal’ tabs to combine the cost processors.

For detailed directions, see the Straightforward Digital Downloads part of our tutorial on how you can settle for Stripe funds in WordPress.

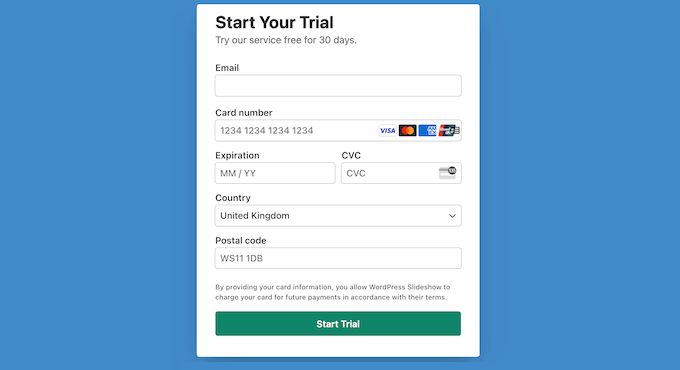

How you can Set Up Fee Processing for Recurring Subscriptions ☁️ 🔒 (SaaS and Conventional Memberships)

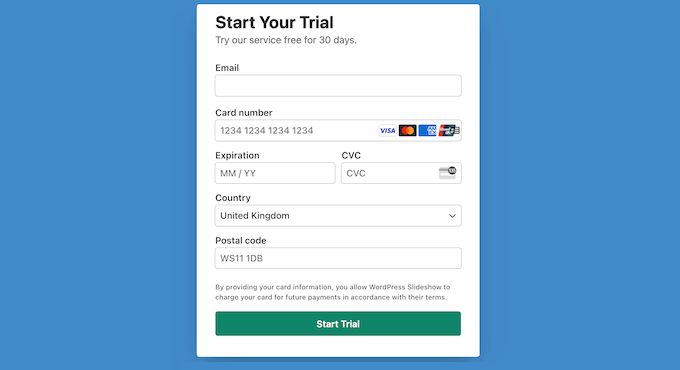

If you’re promoting recurring subscriptions, a SaaS product, or a standard membership, then a cost type that works for recurring subscriptions is your greatest wager.

To get a subscription characteristic on a cost type, WP Simple Pay is good. It comes with built-in integration with Stripe.

Plus, it helps varied native gateways like iDEAL, Bancontact, GrabPay, SEPA, Money App, Affirm, and Klarna. So many choices make it tremendous handy on your prospects to pay.

The very best half? The device offers you an intuitive builder, full spam safety, and quite a few type templates. This lets you begin accumulating funds with out organising a full eCommerce retailer.

We’ve examined this plugin ourselves on actual web sites, and we had been tremendous impressed. See our full WP Easy Pay overview when you’re interested by our experiences with it.

For extra data, see our information on how you can arrange recurring funds in WordPress.

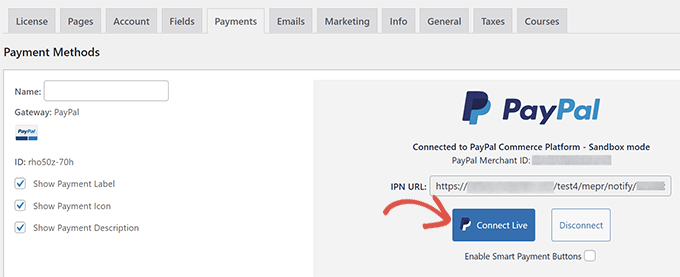

How you can Set Up Fee Processing for Membership Websites 👥 📚 (On-line Communities & eLearning)

If you’re constructing an internet neighborhood or promoting programs, then MemberPress is among the greatest methods to simply accept funds and handle a membership web site.

It helps you to prohibit content material, promote entry to programs, and create unique members-only areas without having a sophisticated setup. Plus, it has built-in help for Stripe and PayPal, so you can begin accepting funds straight away.

At WPBeginner, we’ve been utilizing it to share free video programs with our readers and have had an excellent expertise. To search out out extra, see our full MemberPress overview.

The device is tremendous beginner-friendly, and you’ll simply should comply with the on-screen directions so as to add PayPal or Stripe as a cost choice.

For particulars, see our tutorial on how you can join WordPress to PayPal Commerce.

How you can Set Up Fee Processing for On-line Types 📋 📦 (Order Types and Subscription Bins)

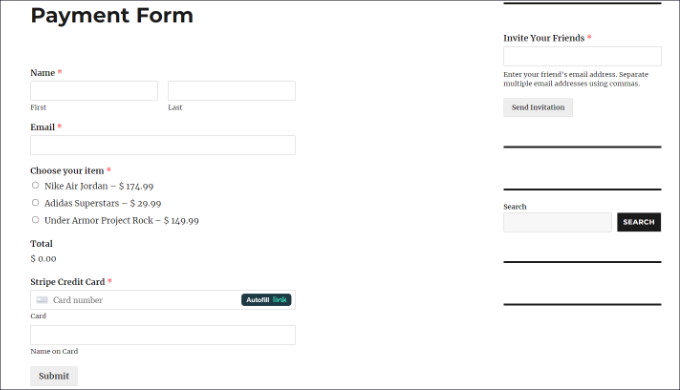

If you have to arrange order kinds or promote subscription containers, then WPForms is a good alternative.

It helps you to create customized cost kinds for on-line restaurant orders, donations, subscription containers, totally different companies, and extra.

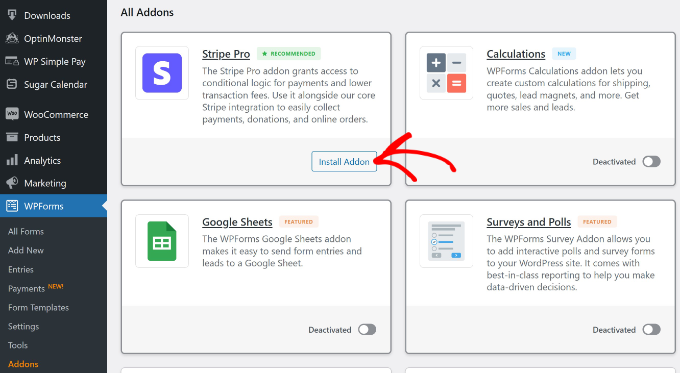

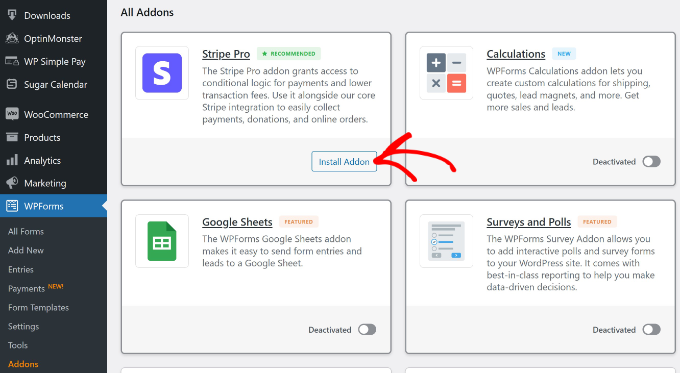

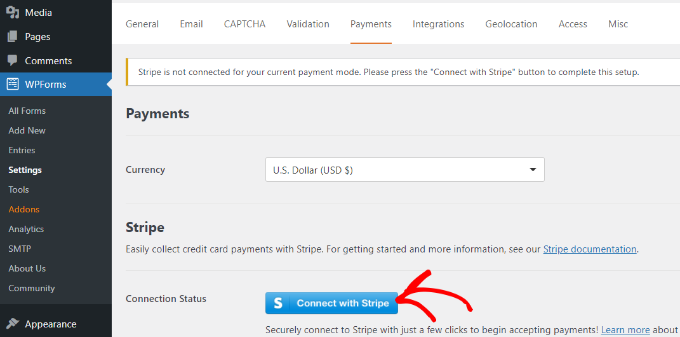

WPForms additionally comes with built-in Stripe and PayPal integration via its addons, so you can begin accumulating funds in only a few clicks.

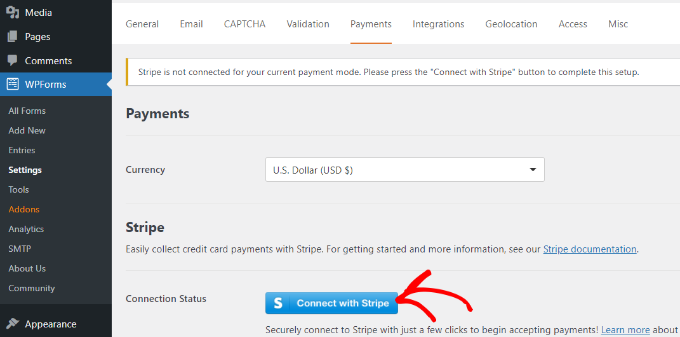

After you obtain the addon, you possibly can simply go to the WPForms » Settings » Funds web page to attach the plugin with the processor.

When you do this, you should use a premade template to construct a type with cost choices.

For step-by-step directions, see our tutorial on how you can settle for Stripe funds in WordPress.

Associated Submit: How you can Create an On-line Order Kind in WordPress

Ceaselessly Requested Questions About WordPress Fee Processing

Listed below are some questions which might be often requested by our readers about WordPress cost processing.

Can I settle for funds internationally with WordPress?

Sure, many cost processors, together with Stripe, PayPal, and Sq., help you settle for funds from prospects worldwide. They help a number of currencies, making it simpler to promote globally.

Nonetheless, it’s essential to test whether or not the processor you select helps the international locations you’re focusing on earlier than you arrange the account.

Is it secure to course of funds on my WordPress web site?

It’s utterly secure to course of funds on a WordPress web site so long as you utilize a dependable cost processor and safe your web site correctly.

Most cost processors use encryption, tokenization, and fraud safety instruments to maintain your prospects’ cost data secure.

Moreover, you must guarantee your WordPress web site has an SSL certificates to encrypt information between your web site and your customers. For extra suggestions, you possibly can see our final WordPress safety information.

Can I take advantage of a couple of cost processor on my WordPress web site?

Sure, you should use a number of cost processors in your WordPress web site. That is useful if you wish to provide your prospects varied cost choices.

For instance, you possibly can combine each PayPal and Stripe, permitting prospects to decide on their most popular technique at checkout.

Do I want a service provider account for WordPress funds?

A service provider account is a particular kind of checking account that lets you settle for funds. These accounts are often offered by a financial institution or a monetary establishment, and they are going to be linked to your cost processor to deal with transactions.

Some processors, like PayPal and Stripe, don’t require you to arrange a separate service provider account. These companies act as each the cost processor and the service provider account, dealing with all of the back-end duties like accumulating funds and transferring them to what you are promoting account.

However, platforms like Authorize.Internet require a separate service provider account.

Total, if you’re simply beginning out with WordPress and need a easy, easy answer, you should use companies like PayPal or Stripe. Nonetheless, if you wish to scale what you are promoting, it’s possible you’ll wish to contemplate a processor that requires a service provider account.

Associated Guides for Accepting Funds in WordPress

On the lookout for extra details about accepting funds in WordPress? Try these associated guides:

Should you preferred this text, then please subscribe to our YouTube Channel for WordPress video tutorials. You may as well discover us on Twitter and Facebook.

Leave a comment